We illuminate the path to fintech excellence. Inspired by the North Star, As a fintech leader in the GCC, we set the standard for transparency and innovation, empowering banks, corporates, and enterprises with secure, intelligent, and scalable financial solutions.

We exist to simplify complexity, accelerate innovation, and guide our partners toward excellence one transformative solution at a time.To redefine the future of finance across the GCC by delivering secure, intelligent, and scalable fintech solutions that empower banks, corporates, and enterprises to thrive in a digital first economy.

To pioneer the path for fintech transformation, establishing the standard of excellence, innovation, and trust across the GCC’s financial ecosystem. To guide the path for fintech transformation, defining excellence, innovation, and trust across the financial landscape of the GCC.

Innovation is more than technology; it's the engine that drives smarter, faster, and more secure financial ecosystems. We continuously explore emerging fintech trends, adopt cutting-edge architectures, and design solutions that anticipate tomorrow’s challenges. By transforming complex processes into seamless digital experiences, we empower organizations to stay ahead, scale confidently, and compete in an ever-evolving financial landscape.

Software Solutions Experts

We don’t just build software, we build the digital backbone of modern finance.Our solutions are designed to empower businesses, banks, and corporates with secure, scalable, and intelligent technologies that drive innovation, ensure compliance, and accelerate growth across the fintech ecosystem.

KYC

Redefine digital onboarding with advanced eKYC. Our AI‑driven platform unites biometric verification, demographic checks (age, race, gender), and real‑time analytics to deliver instant authentication. Built for speed, security, and full regulatory compliance, it empowers financial institutions to onboard customers seamlessly while inspiring trust from the very first interaction.

Payment infrastructure

Unlock growth with Bantech’s secure payment link solutions. Whether online or in person, our platform makes it simple to generate trusted payment links that empower your business to accept transactions seamlessly. Build flexible revenue models, embed financial services, and deliver a frictionless payment experience designed to inspire confidence and drive profitability.

Invoicing

Simplify invoicing and unlock growth with Bantech’s platform. Seamlessly manage flat‑rate, usage‑based,while reducing churn through smarter subscription management. Our solution streamlines finance operations, ensuring accuracy, compliance, and efficiency so your business can focus on scaling revenue, not chasing invoices.

Consultancy

Analyzing your existing systems, workflows, and integrations to identify gaps, inefficiencies, and opportunities for innovation. From architecture design to implementation planning, we deliver actionable roadmaps that optimize performance, security, and scalability. This ensures your digital infrastructure is future-ready and fully aligned with your business objectives.

Verify users in seconds with AI-powered face recognition, 360° liveness checks, and global document support — all with simple integration and full compliance.

Start Free Trial

Verify users in seconds with AI-powered face recognition, 360° liveness checks, and global document support — all with simple integration and full compliance.

Explore Digital Transformation

We build bespoke software systems tailored to your operations, with modular, secure, and seamlessly interoperable architectures

We assess infrastructure, integrations, workflows, delivering modernization roadmaps aligned with performance, scalability, and security.

We build high-performance mobile apps with native or cross-platform frameworks, optimized for speed, reliability, security.

We create optimized corporate websites with clean architectures, secure codebases, and scalable, fast-loading enterprise interfaces.

We provide DevOps as a service, embedding regulatory assurance, resilient automation, and enterprise‑grade scalability.

We design SaaS platforms with multi-tenant infrastructure, secure authentication, scalable clouds, enabling deployment, versioning, growth.

A centralized platform engineered to handle requests, track operations, and complete payments with maximum efficiency.

Explore Bantech’s Media Center for dynamic fintech stories, press updates, and insights driving innovation, trust, and digital transformation.

Explore Our Media Center

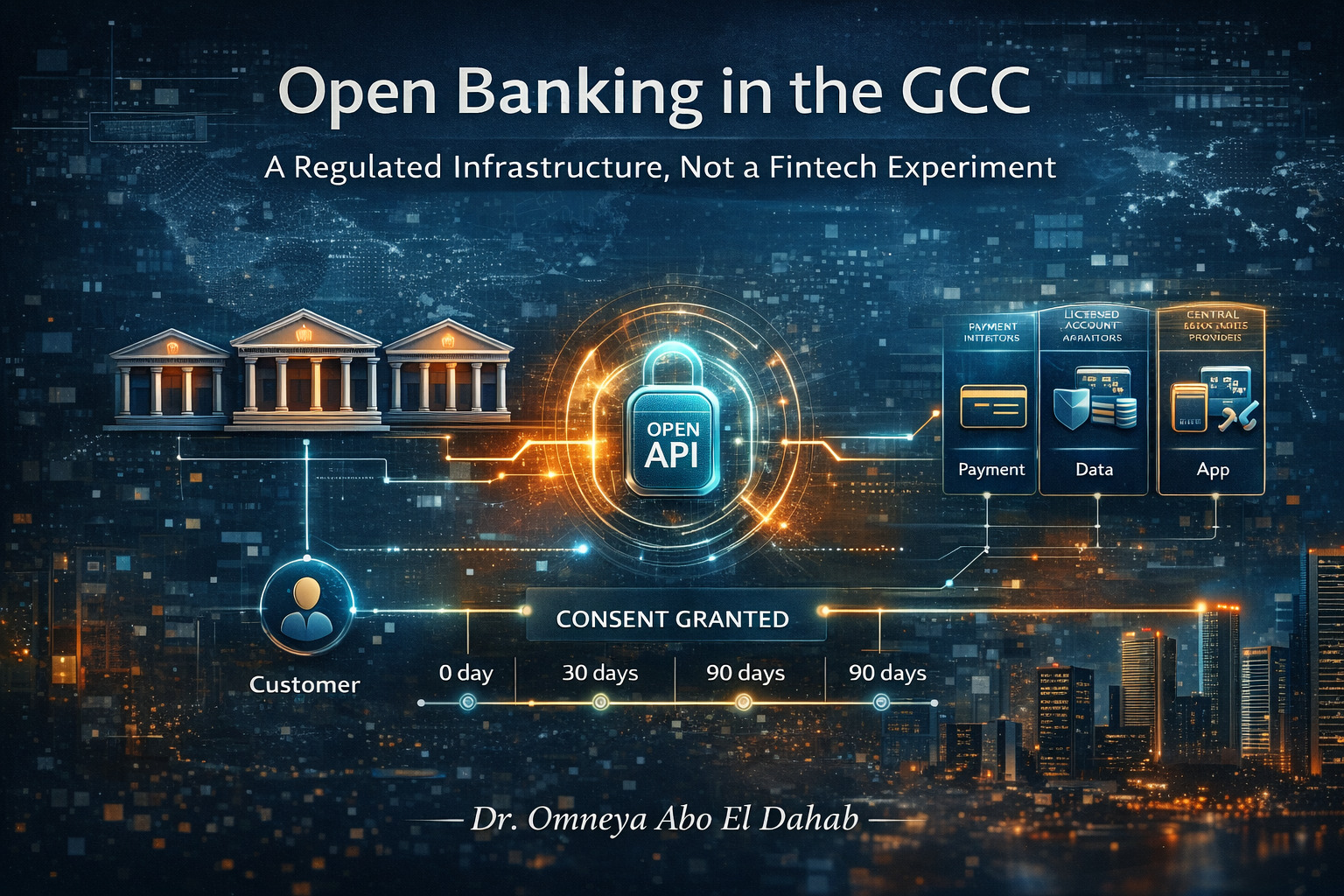

Unlike early European models driven by competition mandates, Open Banking across the GCC is being introduced through central bank frameworks, licensing regimes, and phased implementation models designed to protect financial stability.

For years, digital payments have been built around one central assumption: the card number is the transaction. Every authorization, security model, and payment experience was designed to protect, transmit, and validate that number.