eKYC solution that delivers rapid, fully automated identity verification across borders, powered by secure, encrypted data processing. Using AI-driven documents and biometric verification, we minimize manual intervention while ensuring regulatory compliance.

The system is optimized for high throughput, low latency, and seamless integration with existing fintech platforms. This enables fast, reliable onboarding while maintaining regulatory grade security and global coverage.

Whether you're scaling a startup or operating at the enterprise level, our eKYC solution adapts to your industry’s needs — offering secure, fast, and compliant identity verification where it matters most.

Enabling organizations to instantly generate a secure verification link directly from the dashboard and share it with the individual or entity to be verified. The link provides a seamless digital KYC journey, allowing users to submit required identity information and documents in a secure, guided flow. This approach accelerates onboarding, reduces manual processes, and ensures full compliance with regulatory standards

Our KYB solution delivers automated, regulation-aligned business verification with secure data checks on entities, directors, and compliance records. Built for scale, it reduces onboarding friction, mitigates risk, and ensures trust through enterprise‑grade integrity.

With a 96% first-try success rate and 99.9% fraud detection, our AI continuously improves to reduce false positives and user drop-offs.

From 100 to 1 million verifications per month, our infrastructure scales effortlessly to support your growth.

Accept over 10,000+ ID types from 180+ countries, support 30+ languages, and customize flows to fit regional compliance standards.

Reduce user onboarding time by up to 80% with fully automated document scanning, liveness checks, and instant verification — without compromising accuracy.

Average user verification completed globally.

Verification Successful Rate on the first attempt.

Global ID types for fast, accurate verification.

Verification links generated by multiple users.

Faster onboarding time compared to manual KYC.

Startups, SMEs, early‑stage fintechs

Features include:

Free

Scaling fintechs, marketplaces, crypto apps

Features include:

$0.55 / month

High‑risk industries, cross‑border platforms

Features include:

Contact Sales

Explore Bantech’s Media Center for dynamic fintech stories, press updates, and insights driving innovation, trust, and digital transformation.

Explore Our Media Center

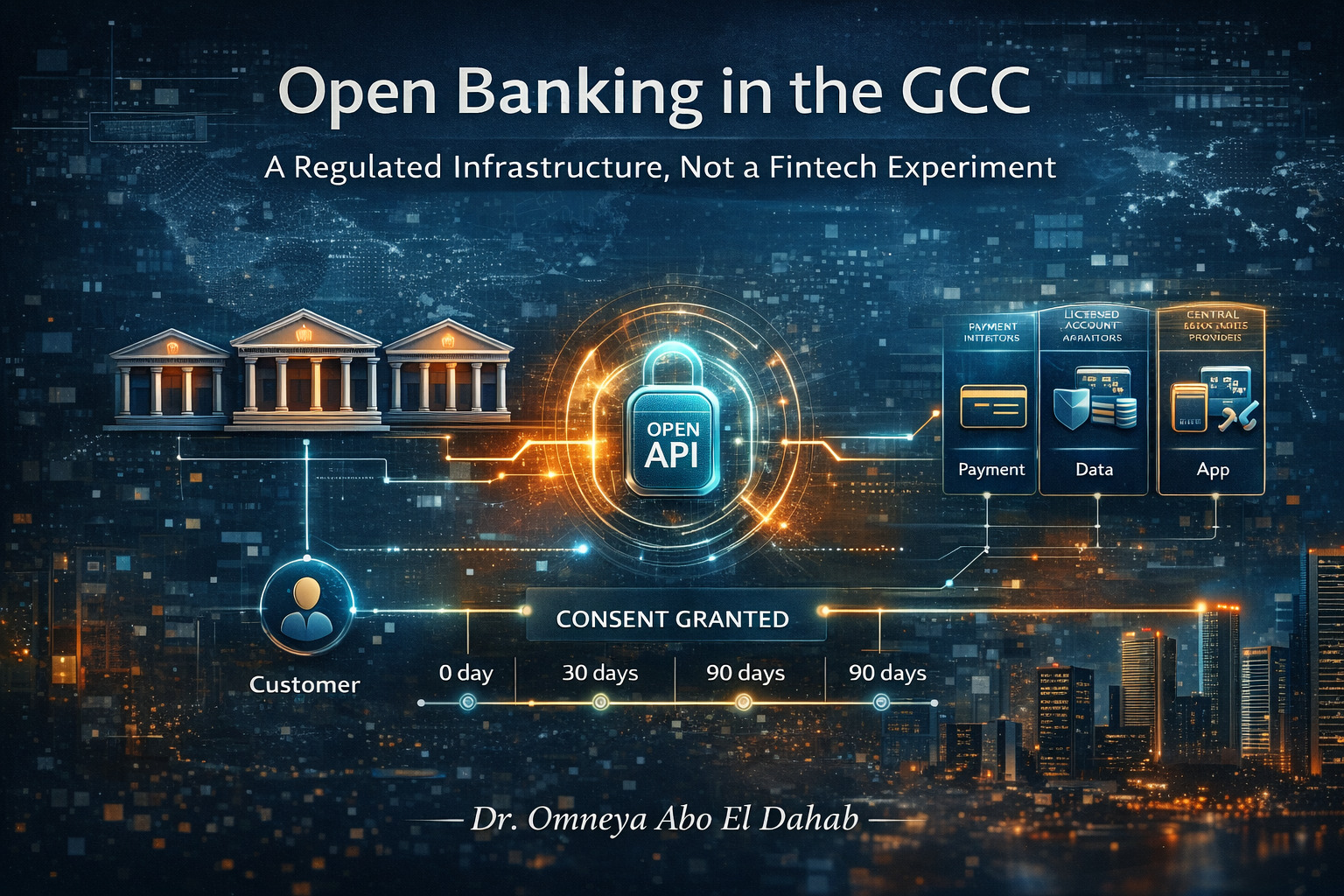

Unlike early European models driven by competition mandates, Open Banking across the GCC is being introduced through central bank frameworks, licensing regimes, and phased implementation models designed to protect financial stability.

For years, digital payments have been built around one central assumption: the card number is the transaction. Every authorization, security model, and payment experience was designed to protect, transmit, and validate that number.