Simplify payments, amplify growth. With smart payment links, businesses send secure, trackable requests instantly,no complex integrations, no manual hassle. From SMEs to global enterprises, accept payments anytime, anywhere, and deliver effortless, reliable transactions customers trust.

Create, customize, and share secure payment links in seconds. Track every transaction in real-time, reduce delays.

Payments made effortless. Smart links let you collect instantly, secure, compliant, and built for growth

Generate secure, encrypted payment links in seconds with all transaction details pre-set for fast, compliant processing.

Faster collection compared to traditional methods.

Supported currencies for global transactions.

Works seamlessly on mobile, desktop, or tablet.

To create and share a payment link.

One dashboard, total control. Centralize payments with a platform built for speed, simplicity, and smarter decisions.

No more chasing invoices every month. With recurring payments, your customers are billed automatically on time — whether it’s weekly, monthly, or yearly.

Whether you’re running a growing startup or managing enterprise operations, our payment solutions scale with your business — delivering fast, secure, and flexible transactions wherever you need them.

Redefining the future of payments. Dynamic QR codes unlock a world of instant, borderless transactions secure, cashless, and built for the digital economy.

What is Bantech’s Payment Service?

Bantech provides a secure, GCC‑ready payment solution that allows businesses to accept online payments through payment links, invoices, and subscription billing — without needing a complex integration.

Which payment methods does Bantech support?

Bantech supports a wide range of regional and international payment methods, including:

Your available methods depend on your acquiring partner and region.

How do payment links work?

Payment links allow you to collect payments without a website.

How fast can I start accepting payments?

Most businesses can start accepting payments within the same day, depending on:

Bantech’s onboarding is designed to be fast, compliant, and frictionless.

Does Bantech store card details?

No. Bantech does not store or process raw card data. All payments are handled through PCI‑DSS‑certified payment processors, ensuring maximum security.

Can I issue refunds through Bantech?

Yes. Refunds can be initiated directly from your Bantech dashboard, subject to your payment provider’s rules and settlement timelines.

How do I track payments?

Your dashboard provides:

Does Bantech support recurring payments or subscriptions?

Yes. Bantech allows you to create recurring invoices and subscription billing with automated reminders and renewal logic.

Where fintech innovation sparks conversation. Explore insights, updates, and milestones shaping digital finance, compliance, and customer trust.

Explore Our Media Center

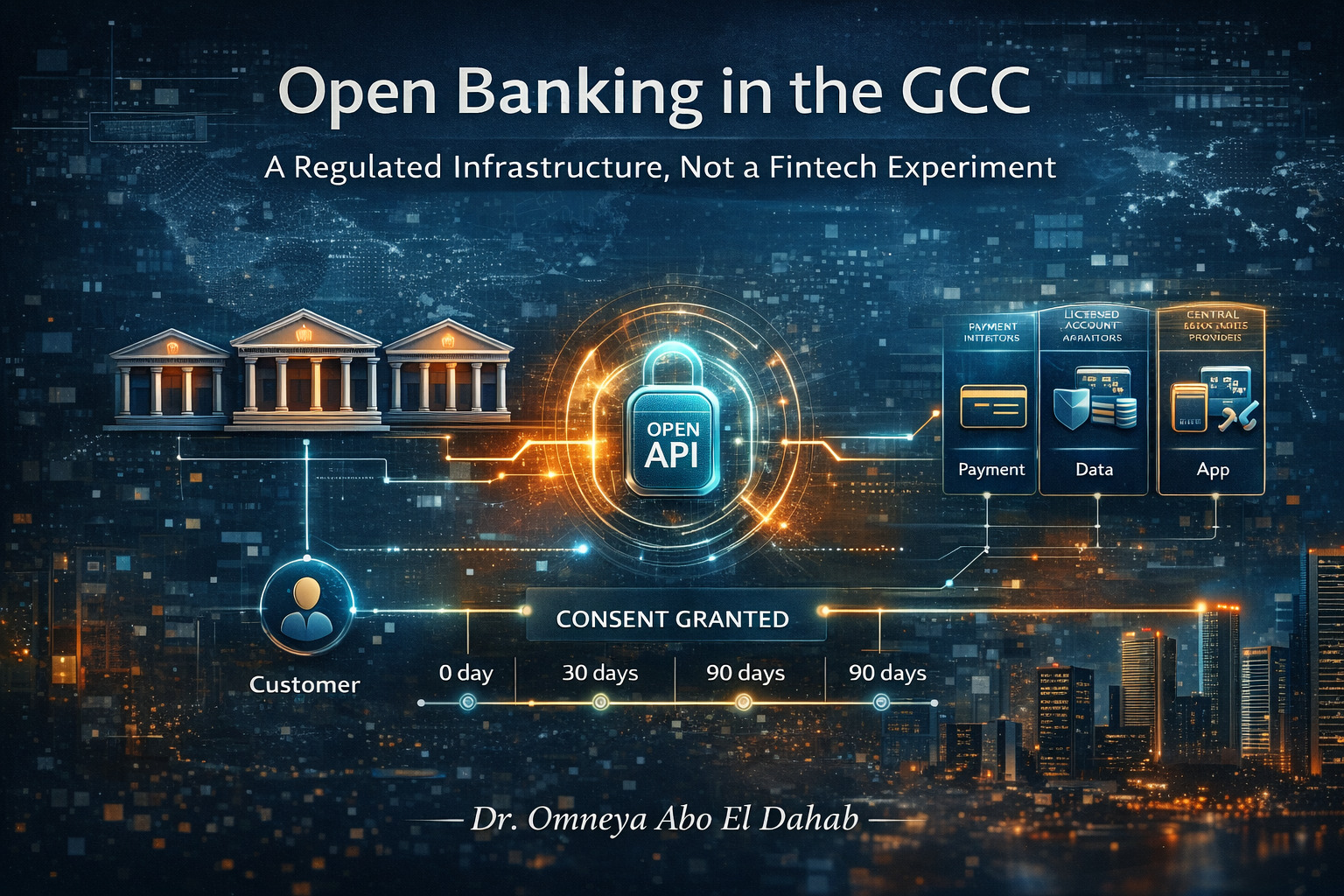

Unlike early European models driven by competition mandates, Open Banking across the GCC is being introduced through central bank frameworks, licensing regimes, and phased implementation models designed to protect financial stability.

For years, digital payments have been built around one central assumption: the card number is the transaction. Every authorization, security model, and payment experience was designed to protect, transmit, and validate that number.