Providing secure, scalable digital solutions that streamline fintech operations and reduce risk. Every interaction is engineered to be fast, reliable, and seamless for businesses and their customers.

We exist to simplify complexity, accelerate innovation, and guide our partners toward excellence one transformative solution at a time.To redefine the future of finance across the GCC by delivering secure, intelligent, and scalable fintech solutions that empower banks, corporates, and enterprises to thrive in a digital first economy.

To pioneer the path for fintech transformation, establishing the standard of excellence, innovation, and trust across the GCC’s financial ecosystem. To guide the path for fintech transformation, defining excellence, innovation, and trust across the financial landscape of the GCC.

Innovation is more than technology; it's the engine that drives smarter, faster, and more secure financial ecosystems. We continuously explore emerging fintech trends, adopt cutting-edge architectures, and design solutions that anticipate tomorrow’s challenges. By transforming complex processes into seamless digital experiences, we empower organizations to stay ahead, scale confidently, and compete in an ever-evolving financial landscape.

Confirm customer identity using reliable documents and digital verification methods.

Evaluate customer risk levels to prevent fraud and financial crime.

Continuously monitor customer activity to detect suspicious behavior and changes.

Confirm customer identity using reliable documents and digital verification methods.

Evaluate customer risk levels to prevent fraud and financial crime.

Continuously monitor customer activity to detect suspicious behavior and changes.

Explore Bantech’s Media Center for dynamic fintech stories, press updates, and insights driving innovation, trust, and digital transformation.

Explore Our Media Center

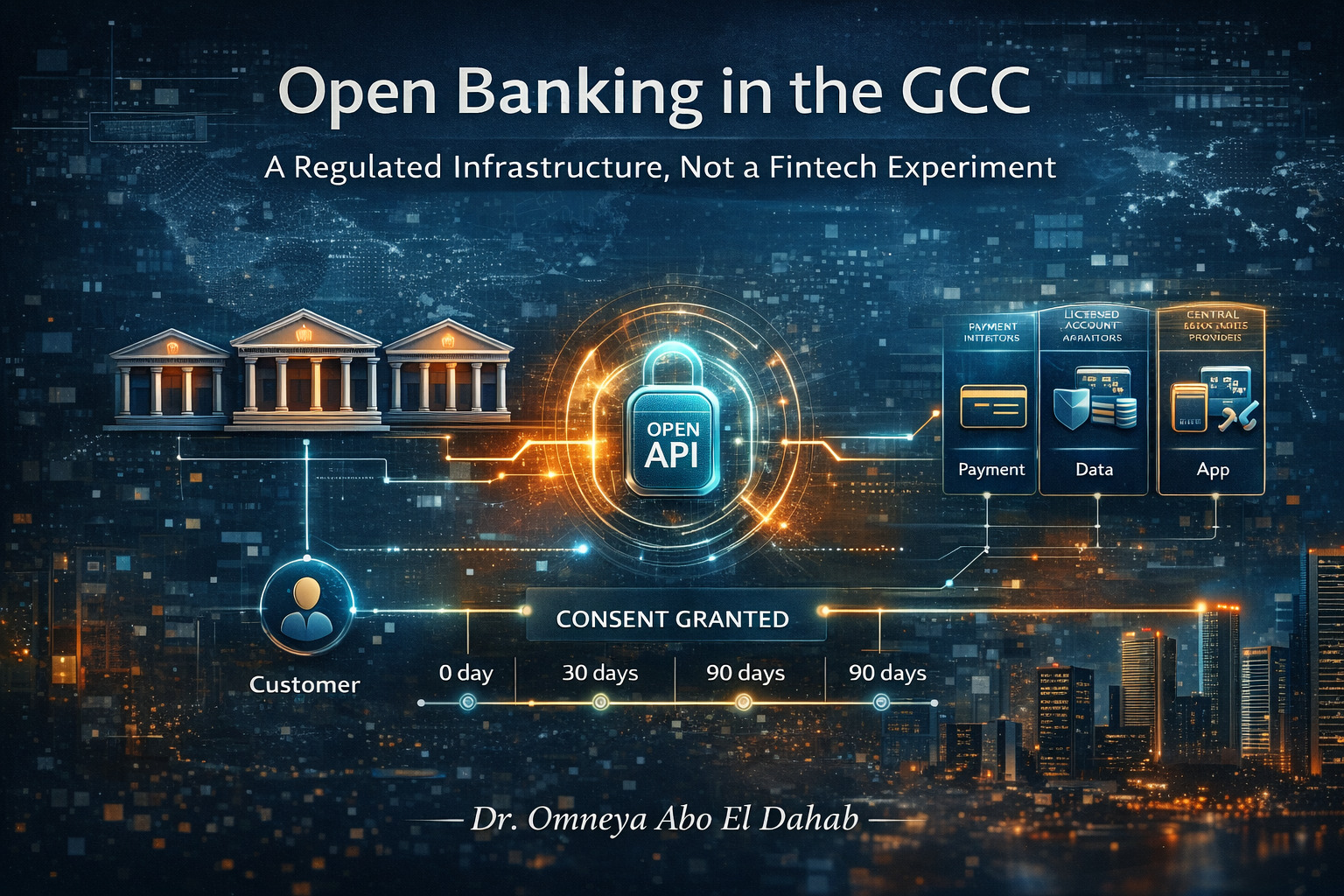

Unlike early European models driven by competition mandates, Open Banking across the GCC is being introduced through central bank frameworks, licensing regimes, and phased implementation models designed to protect financial stability.

For years, digital payments have been built around one central assumption: the card number is the transaction. Every authorization, security model, and payment experience was designed to protect, transmit, and validate that number.